Online Gambling Industry Report

- Online Gambling Industry Statistics Uk

- Online Gambling Industry Statistics Us

- Online Gambling Industry Report

- Online Gambling Industry Statistics

The Online Gambling (Global) analysis is the most definitive and accurate study of the Online Gambling (Global) sector in 2019. The report is split into two sections and uses both a written and graphical analysis - analysing the 200 largest Online Gambling (Global) companies. Technological advancements across the online gaming industry are expected to favorably impact market growth over the forecast period. Regulatory shifts and the proliferation of smart devices are also expected to fuel market demand. However, a few government regulations banning online gambling may pose a threat to the online gaming market. Scope of the Report The online gambling market includes gaming types, such as betting, bingo, lottery, casino, and other gambling games include poker and country-level games. The online gambling market by device type is categorized as mobile and desktop gambling games. Key Market Trends Online Betting Holds a Prominent Share among the Online.

Industry Insights

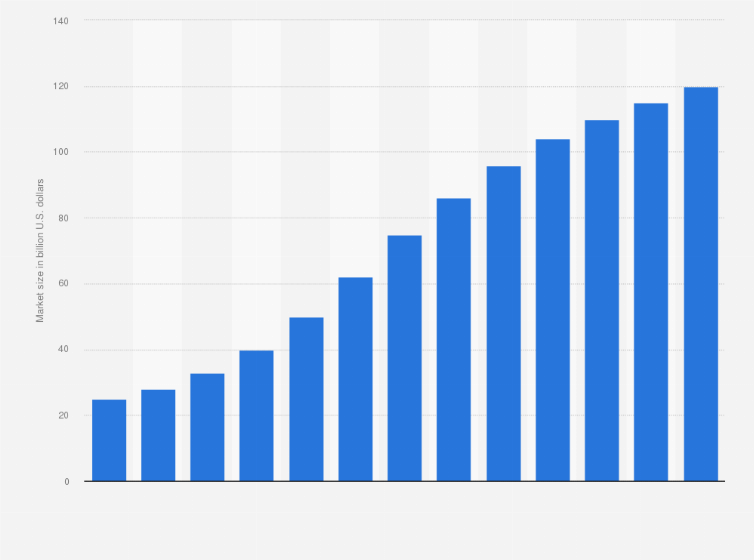

The global online gambling market size was valued at USD 27.56 billion in 2014 and is expected to grow at 9.8% CAGR over the forecast period. Continuous technological advancements such as handheld devices and smart phone penetration are key driving factors in the market. This, in turn, has resulted in rise in consumer inclination toward online gambling over conventional gambling.

Global online gambling market, by type, 2014 - 2024 (USD Billion)

Online gambling has emerged as one of the mainstream leisure pursuits for consumers especially in countries such as Canada, U.K., Brazil, and U.S. Owing to advancements in mobile technology, there has been significant transformation from casual slot playing to online gambling, irrespective of place and time. Increasing penetration of mobile devices such as smartphones and tablets, along with growing availability of broadband services, is expected to propel demand over the forecast period.

Moreover, increasing adoption of cost-effective payment mechanisms among consumers is a key factor increasing investments in the market. Introduction of technologies such as virtual reality and augmented reality is expected to increase popularity of online gambling during the forecast period.

Rise in tax percentage by local governments on online gambling platforms is anticipated to hinder market growth over the forecast period. For instance, the European Union revised its tax rates on online services for some European countries in January 2015 by increasing value-added tax (VAT) to millions of dollars per year.

The online gambling market is witnessing lucrative growth as it is being targeted by cybercriminals by costing players billions of dollars. Money transferred via different payment gateways such as electronic checks, credit cards, and wire transfer is targeted by bots sent by cybercriminals and easily intruded.

However, companies are taking steps to resolve this issue by raising awareness among users and urging them to install anti-virus software on PCs and smartphones. In addition, company websites are being protected by third-party applications to secure online money transactions.

Segmentation by Type

• Sports Betting

• Casinos

• Poker

• Bingo

• Others

Based on type, the market is segregated into sports betting, casinos, poker, bingo, and others. The sports betting segment dominated the market in 2016 with more than 40% of the revenue. It is expected to maintain its position over the forecast period. The segment comprises many sports such as tennis, basketball, cricket, and football. Football contributes a major share owing to massive global fan following compared to other sports.

Owing to ongoing developments in online gambling platforms, a punter can place a bet in real time. Moreover, betting on individual players, red cards, and goals in the game has been simplified. Additionally, casinos, poker, and lottery are likely to emerge as lucrative segments in the market owing to rise in participation of consumers to earn offers and rewards.

Casino is the second largest segment in the online gambling market, which accounted for USD 8.13 billion in 2016. Availability of a wide range of games such as Blackjack, Big Six wheel, and Roulette and technological developments such as real-time betting are expected to drive the segment over the forecast period.

Segmentation by Region

• North America

• U.S.

• Europe

• U.K.

• Asia Pacific

• Australia

• Central & South America

• Africa

Europe dominated the market in 2016 and valued USD 18.06 billion in terms of revenue. It is anticipated to maintain its position over the forecast period due to growing number of people involved in gambling. In addition, consumers prefer smartphones and tablets to gamble online over visiting brick and mortar shops.

Asia Pacific is projected to record a CAGR of more than 10% over the forecast period. Change in regulations and development of online gambling platforms in countries such as China, India, and Japan can also be attributed to growth. For instance, companies such as Bet365 Group Ltd. and Sports Betting & Gaming offer online gambling platforms in these countries.

Competitive Landscape

The online gambling industry is fragmented in nature and is marked by presence of numerous domestic and international players around the world. Moreover, companies are undertaking various strategies such as mergers and acquisitions (M&A) to establish their presence in the market.

For instance, in February 2016, GVC Holdings acquired online gaming company Bwin to strengthen its presence in the global market. Key companies operating in the online gambling industry include William Hill plc.; Bet365 Group Ltd.; Paddy Power Betfair plc.; Betsson AB; Ladbrokes Coral Group plc.; Amaya Inc.; 888 Holdings plc.; Sky Betting & Gaming; Kindred Group; and GVC Holdings plc..

The Impact of Fraud & Chargebacks on the Fast-Growing Online Gaming Space

Online gaming can be a fun, exciting pastime, and it’s attracting millions of new players each year. A massive sector of the digital economy, we can attribute 11% of total internet traffic globally to online betting. Incredible as that sounds, the online gaming market remains on a trajectory of rapid growth.

Traffic to online betting sites in the UK, for instance, is up 300% since introduction of the Gambling (Licensing and Advertising) Act of 2014. The mobile gaming market is the fastest growing segment of the market by a wide margin, now representing 43% of total traffic.

Online Gambling Industry Statistics Uk

The financial impact of this rapid growth is staggering. According to Juniper Research, total online wagers—including casino games, sports betting, and other avenues—will reach nearly $1 trillion a year globally by 2023. That translates to nearly 1% of projected global GDP.

There are several factors at play here. First, we’ve seen a rise in the acceptability of online gaming among the general populace. Also, the increasingly-interconnected digital market makes it hard to enforce regional or national prohibitions. From every indication, we’re toward a market in which borderless online gaming seems more and more like a reality*.

*Can I Accept US Players?

The US market is huge; it’s the world’s second-largest digital economy. But, it can be a complicated process for gaming sites looking to get a piece of the pie. Accepting bets online across state lines is illegal in the US. The law less clear, though, regarding US consumers placing bets with services based internationally [1]. However, most assert that accepting bets from the US is, in fact, legal [2].

Of course, as the market grows, so does the associated risk. Given the prospective growth in the industry over the next few years, we really can’t afford to be cavalier about fraud in the online gambling marketplace.

The Current State of Fraud in Online Betting

Fraud in the gaming industry is a serious concern. The ThreatMetrix Gaming and Gambling Cybercrime Report reveals that roughly one in every 20 new accounts created with an online gaming site is connected to a fraudster. The same report claims that bot attacks can account for up to half of daily traffic during peak attack periods.

Don’t Gamble on Fraud & Chargebacks.

Talk to the experts and start recovering revenue today.

One of the most common tactics fraudsters employ is a form of synthetic identity fraud. First, a criminal creates dozens or even hundreds of accounts using fake user credentials. He may then use those fake accounts for multiple purposes:

- Bonus Abuse: Each account collects promotional bonuses or rewards for signing up, which the fraudster then cashes in.

- Gnoming: The bad actor uses multiple accounts to drive up bonuses and jackpots, then reap the winnings.

- Chip Dumping: Like gnoming, this involves multiple accounts joining a game and deliberately losing to one specific account.

These are just a few examples. Criminals can also engage in any number of common eCommerce fraud tactics, including account takeover and clean fraud.

What’s more, despite the prevalence of fraud in the online game space, it’s not easy to pick out fraud from legitimate users. For example, players often employ tactics like IP spoofing, VPNs (virtual private networks), and other techniques to hide their location. Using any of these techniques could be a sign of fraud…but that’s not necessarily the case. You could end up turning away legitimate buyers by accident.

Risk of Chargeback Abuse in the Gaming Industry

Customers have some recourse when they get burned by fraudsters, however. The legitimate cardholder can file a chargeback to recover the funds stolen by criminals. Chargebacks, as they were designed, are an important and useful fraud protection mechanism. Unfortunately, the merchant of record doesn’t have any such protections; what’s worse, consumer chargebacks often end up being used as a tool to commit fraud, rather than recover from it.

“Friendly fraud” occurs when a customer files a chargeback instead of trying to first obtain a refund from the merchant. For whatever reason, the authorized cardholder disputes a legitimate charge. This pushes the bank to force a refund under the pretense that the merchant made an error, or that the transaction was fraudulent.

Friendly fraud goes hand-in-hand with another tactic called “cyber shoplifting.” This occurs when a user completes a transaction with the preconceived intent to file a chargeback later. It’s a way of getting something for free. While the latter is more insidious, the result is the same: the cardholder gets the money back, while you lose out.

Of course, it’s not entirely hopeless; you can recover some of the money lost to friendly fraud and cyber shoplifting through the representment process. This, however, involves in-depth knowledge of card scheme policies and regulations, and must be conducted on a very short timeline.

50 Insider Tips to Preventing More Chargebacks

Download our FREE guide that outlines 50 step-by-step effective chargeback prevention techniques. Learn insider secrets that will reduce your risk of chargebacks, increase your profits and ensure your business's longevity.

Free DownloadWhat Can Gaming Merchants Do?

Authenticating users and providing a quality customer experience is vital to prevent fraud and chargeback abuse. That’s easier said than done, though.

Th current situation puts online betting shops in a difficult position. Some degree of friction in the customer experience is necessary to deter fraud, but too much friction can turn away legitimate users. One report published by Jumio found more than 25% of potential online gambling customers abandoned the account opening process before completion, claiming the process was too lengthy or complex.

Merchants must balance the need of authentication with the demands of the customer experience. The only way to accomplish this is to separate positive points of friction from negative ones.

A “positive” friction point is one which presents a reasonable and minimal degree of friction that is ultimately negligible relative to the protection it provides. Some examples of positive friction include:

- Verifying card CVV when connecting it to the user’s account.

- Asking users to verify each addition of funds before finalizing.

- Requiring complex and unique passwords for all new accounts.

- Offering 3-D Secure 2.0 for users who opt-in to the service.

- Employing backend fraud tools (geolocation, IP verification, fraud scoring, etc.).

- Offering mobile payments with two-factor authentication.

- Verifying the age of individual users to prevent underage abuse of online gambling.

In contrast, “negative” friction slows down transactions and impacts the customer experience while providing little real protection against fraud and chargebacks. Examples of this can include:

Online Gambling Industry Statistics Us

- Overly complicated (or broken) site navigation.

- Excessive or redundant fields during account creation and funding.

- Limiting your accepted payment methods.

- Deploying outdated or ineffective verification methods.

No Strategy Will Ever Be Perfect

Online Gambling Industry Report

Even after adopting positive friction points and eliminating negative ones, you’re still not entirely protected.

As we discussed at the top, the gaming industry is a fast-moving space. The nature of the industry requires you to stay on top of technological advancement, as well as industry regulations, card scheme rules, international law…and more. That can seem intimidating, but partnering with industry experts to manage different facets of your business strategy can make it much easier.

Online Gambling Industry Statistics

Chargebacks911® is the leading brand in the chargeback management space. We partner with merchants, acquirers, and processors operating in the gaming space to produce real, lasting, chargeback reduction. Click below to learn how you can reduce costs and recover revenue today.